Client Onboarding KYC onboarding for wealth management — faster, clearer, fewer errors

Overview

Problem

Wealth onboarding is complex (KYC/AML, multiple products, document capture) and legacy tools made it slow and error‑prone for both investors and relationship managers.

Goal

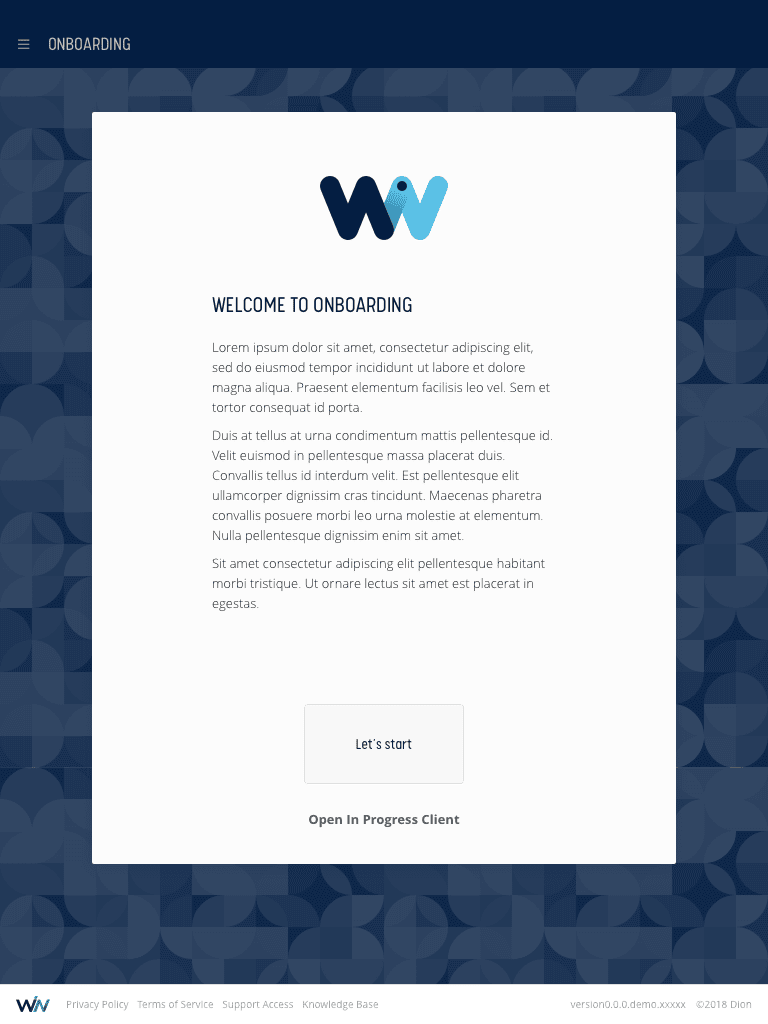

Design a configurable onboarding product that an investment manager can run collaboratively with a client — letting either party enter data — to reduce time, errors, and anxiety while staying compliant.

Challenges

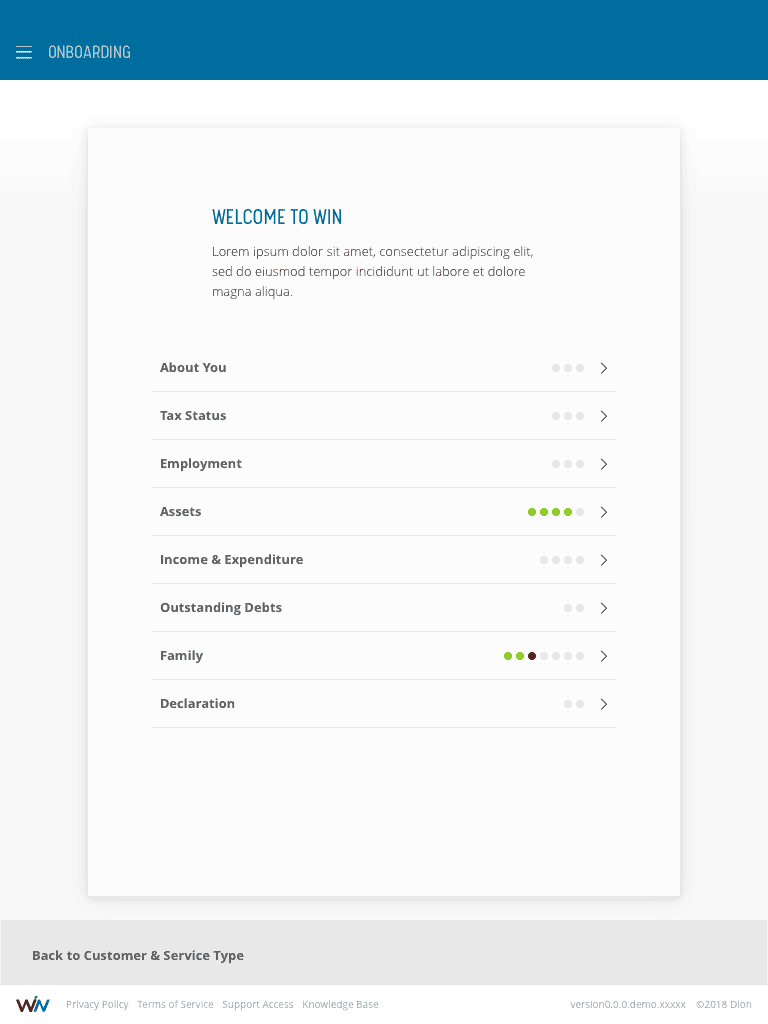

- Designing a hub‑and‑spoke journey to make a long, compliance-heavy process feel manageable and non‑linear.

- Supporting advisor‑led and self‑serve modes with seamless handoff between manager and client.

- Building a configurable workflows component to reflect different firm offerings and jurisdictional requirements.

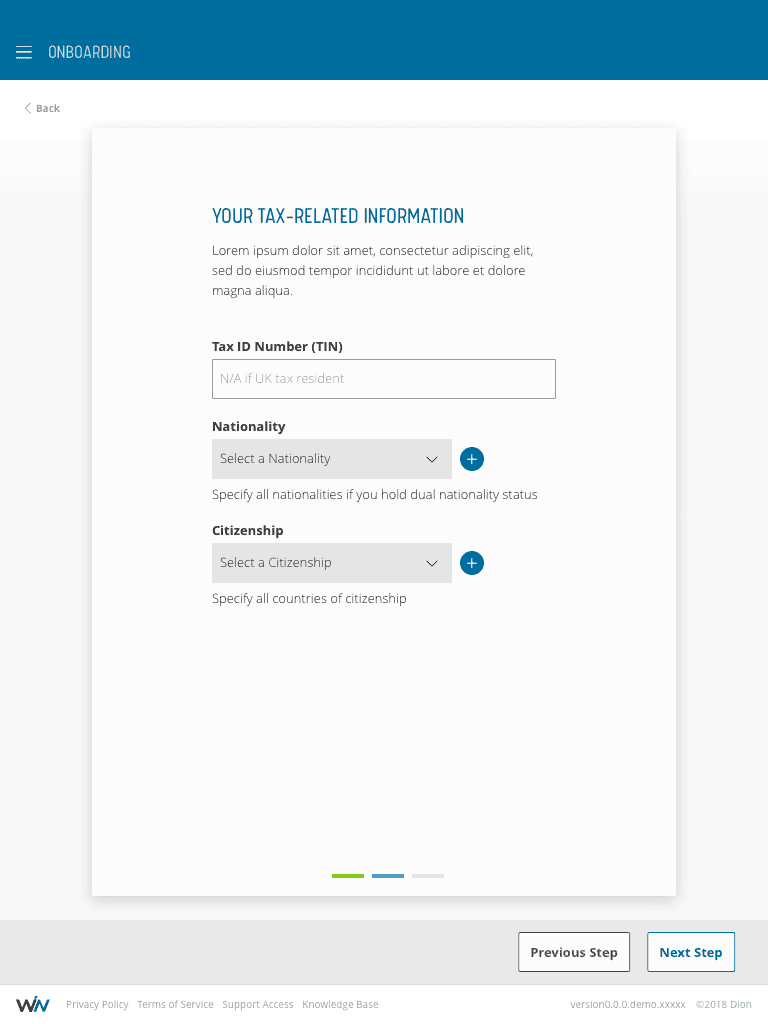

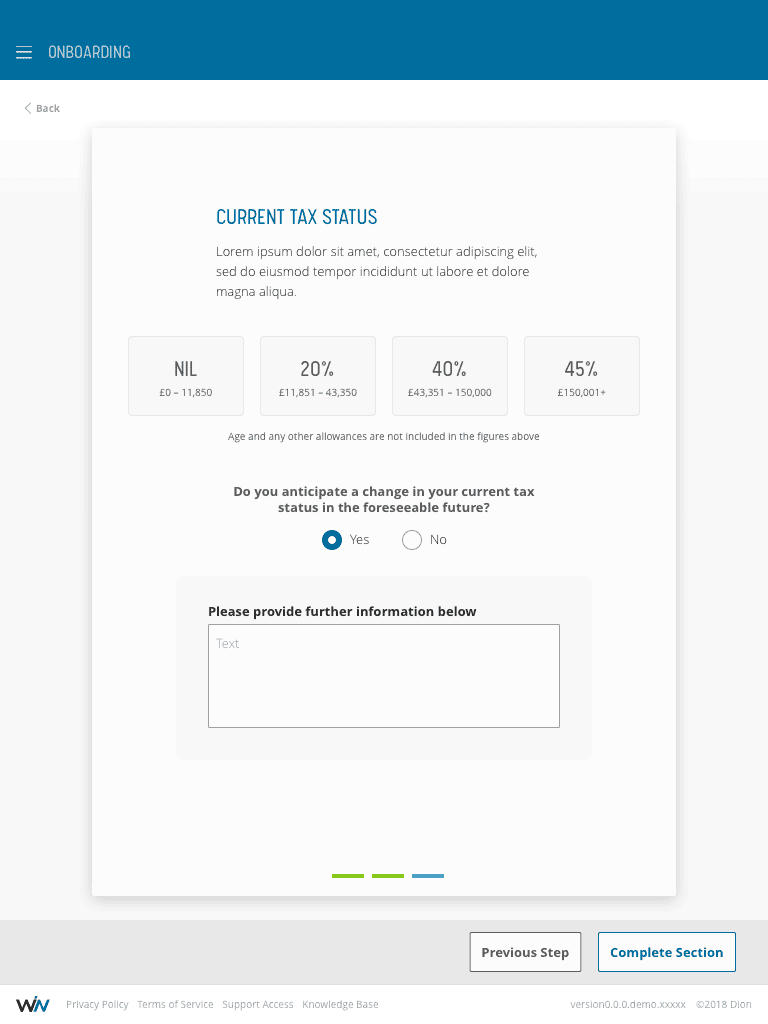

- Meeting KYC/AML needs while maintaining clarity and reducing data entry fatigue.

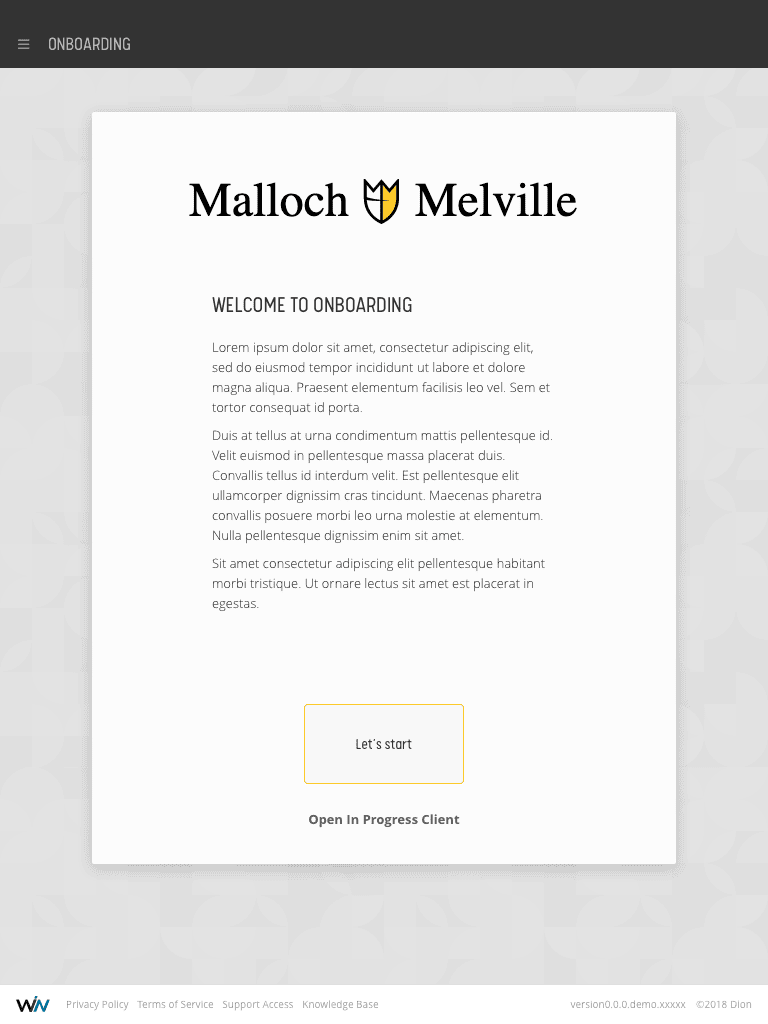

- White‑labelling across firms with consistent UX and accessible UI.

Role Lead UX Designer

Responsible for end-to-end UX and visual design, including research synthesis, journey mapping, wireframes, prototypes, high-fidelity design, and supporting developer implementation.

Team

7 product squads (2–3 developers and 1 product owner per squad), supported by product owners, business analysts, SME stakeholders, front-end and back-end engineers, QA specialists, and additional designers where required.

Responsibilities

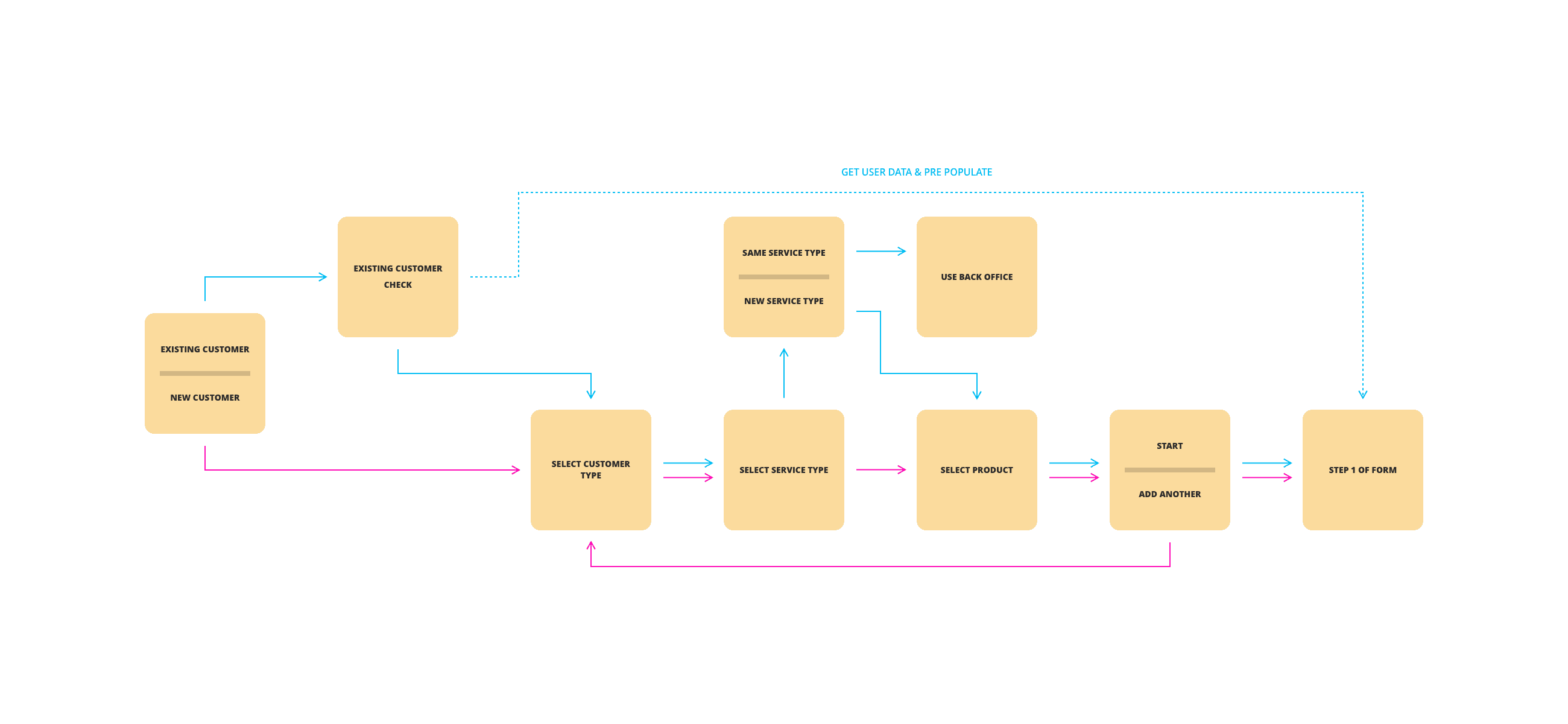

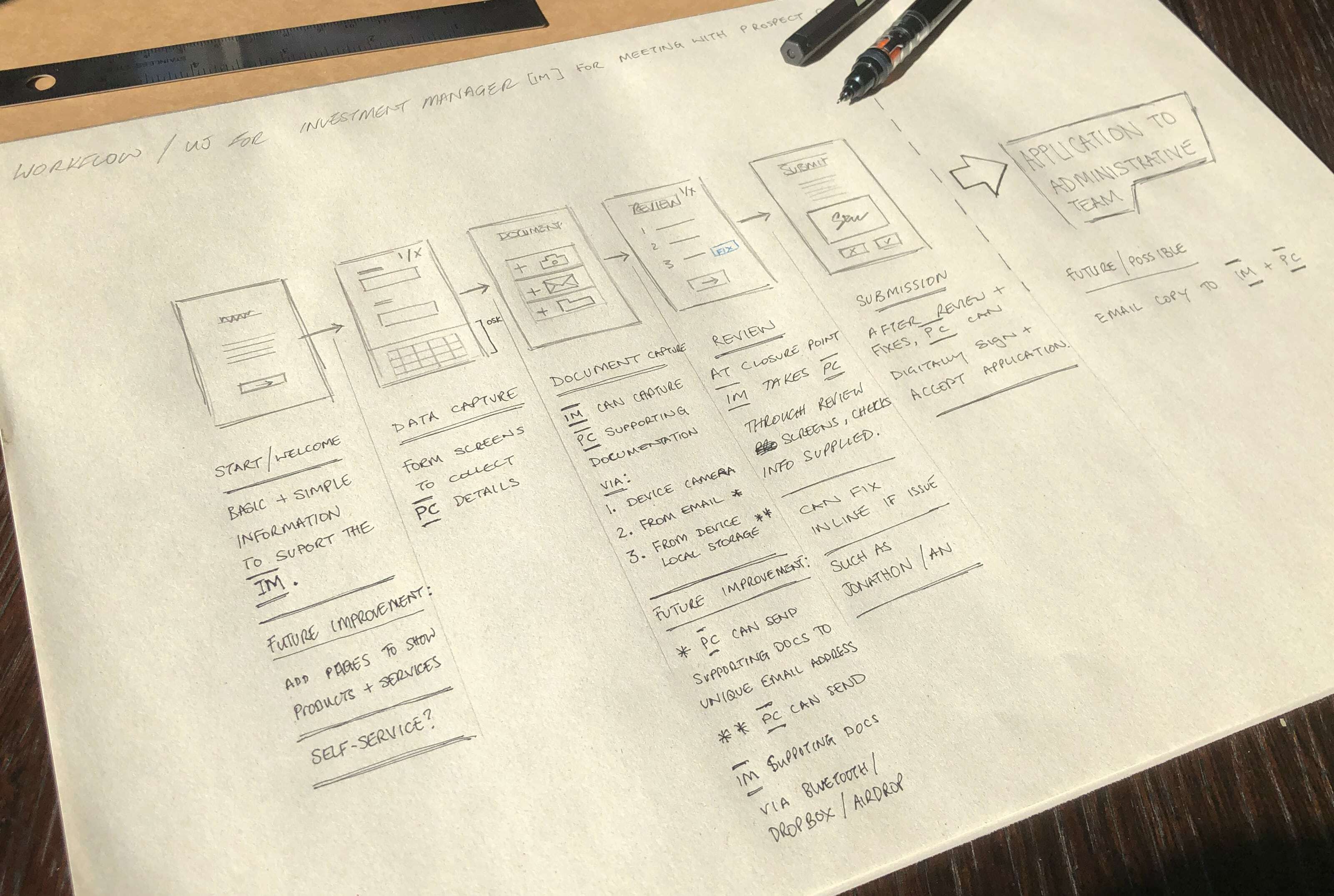

- Consolidated BA research; mapped advisor + investor journeys and key scenarios.

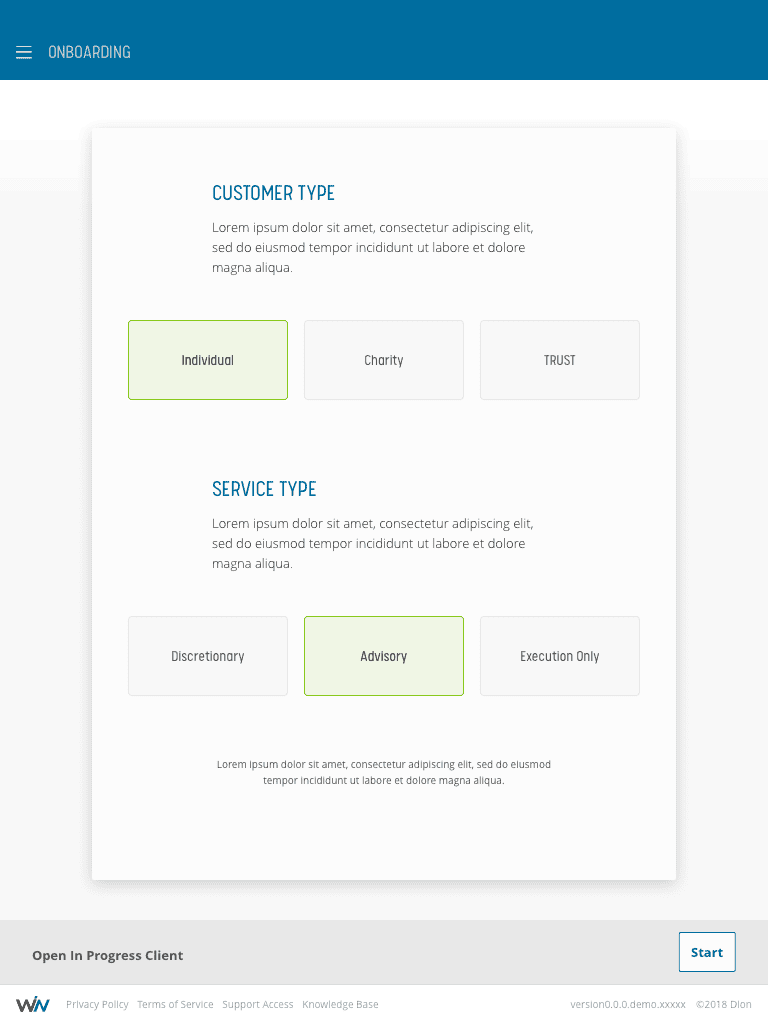

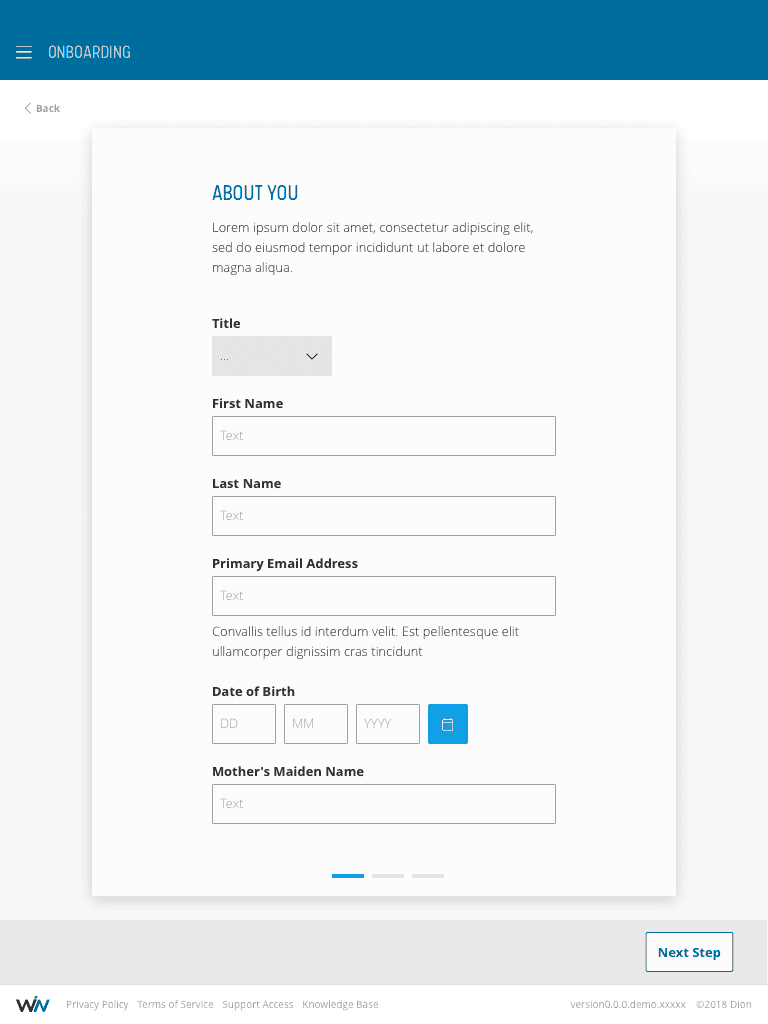

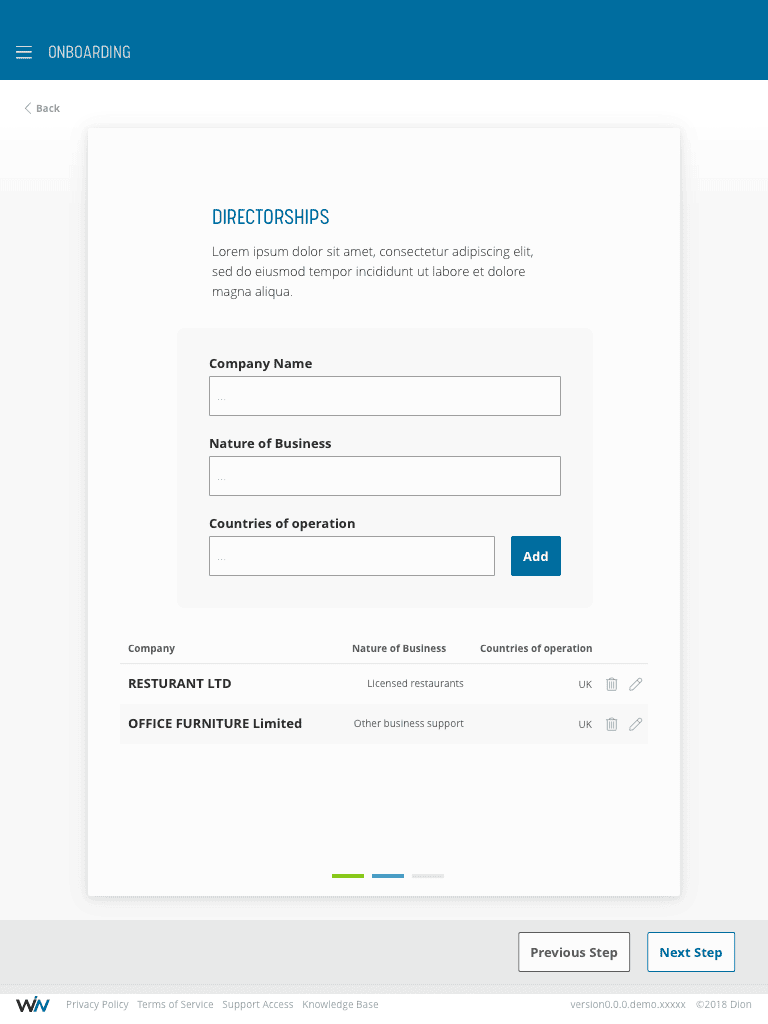

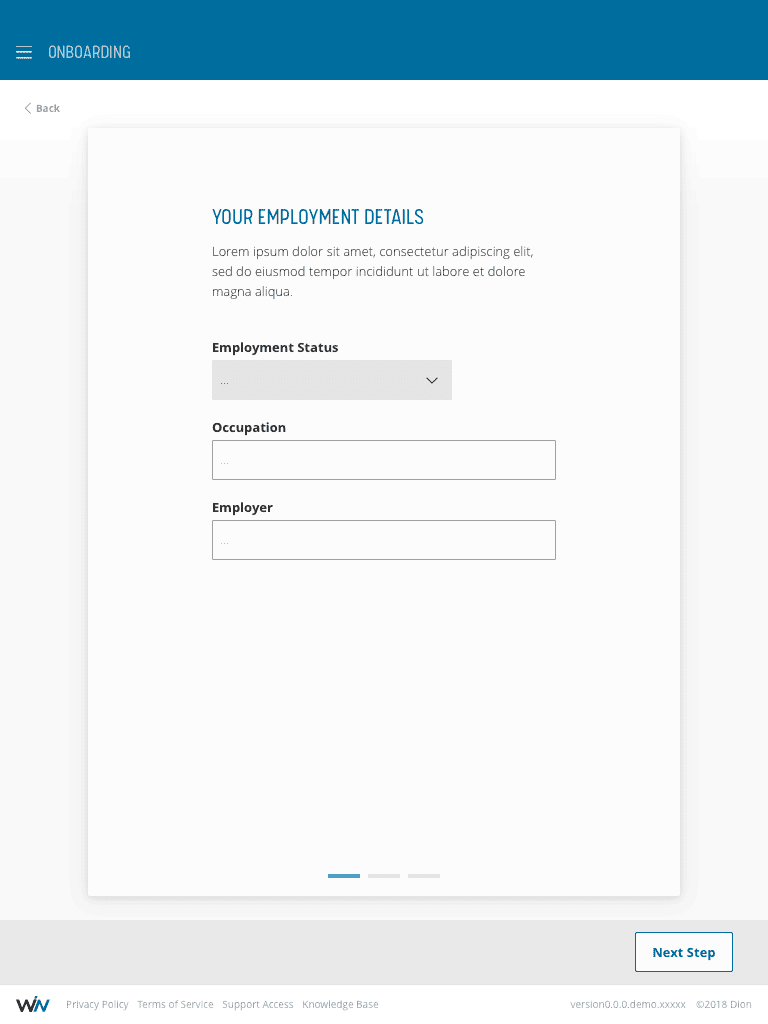

- Designed hub‑and‑spoke IA, progressive disclosure, and dual‑mode data entry.

- Prototyped, tested, and iterated flows; produced high‑fidelity UI and assets.

- Defined configurable workflow patterns; supported engineers through build.

- Ensured accessibility and white‑labelling alignment with the platform Design System.

Approach

- Frame the journey clearly — hub‑and‑spoke IA so users can see progress, jump between sections safely, and avoid getting lost.

- Research → Journeys → Wires — synthesised research, captured core scenarios, and storyboarded the end‑to‑end path for both advisor and investor.

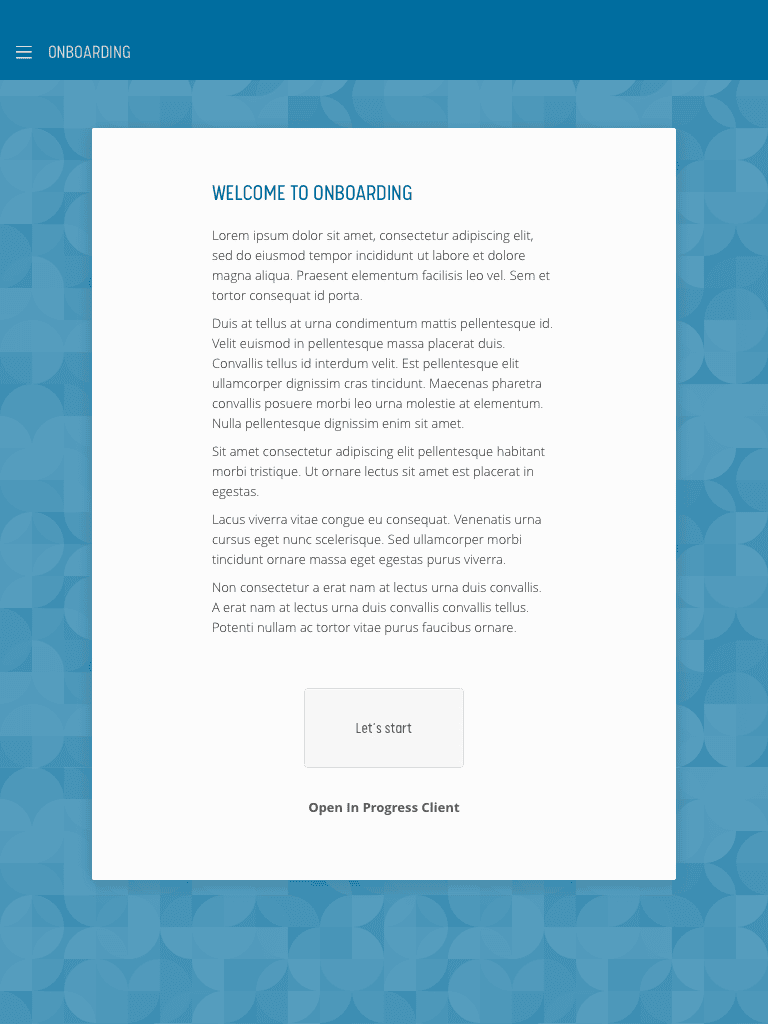

- Low‑fi to hi‑fi prototyping — iterated from greyscale to production UI to validate steps, grouping, and progressive disclosure.

- Configurable workflows — a modular “workflows” component lets firms tailor which steps appear and in what order, without forking UX.

- White‑labelling & accessibility — applied the platform design system so multiple brands could ship with consistent, AA‑compliant UI.

- Advisor–client collaboration — flows support switching who enters data, keeping advisors in control while enabling client self‑entry when appropriate.

Solution

A configurable onboarding experience that:

- Uses hub‑and‑spoke navigation, progressive disclosure, and clear section states to reduce anxiety and errors.

- Lets advisors and clients share data entry safely, improving speed without losing control.

- Ships as a white‑labelled product aligned to the platform Design System for fast rollout across firms.

- Provides a workflows component so POs can tailor steps to products and jurisdictions without redesign.

Impact & Results

- 100% adoption

- +63% data quality

- ~50% faster onboarding

Quantitative Outcomes

- 100% adoption among pilot clients pre-launch

- 63% improvement in data quality and reduction in errors

- Onboarding time reduced by around 50%

Qualitative Outcomes

- Strong enthusiasm in demos and stakeholder sessions

- Higher confidence from sales and relationship teams when demoing

- Improved collaboration between advisors and clients through dual-mode data entry

Reflection

- Visual framing and progress signalling do heavy lifting in long, regulated flows.

- Configurable patterns beat bespoke builds for speed and maintainability.

- Designing for advisor–client collaboration changes both IA and microcopy; it’s not just “add a permission toggle.”